– Walgreens Boots Alliance will close 1,200 stores over three years, starting with 500 in 2025.

– This strategy is chosen by the CEO to stabilize operations.

– The company seeks to improve financial stability by reducing operating costs. Efforts will be made to relocate employees.

Walgreens Boots Alliance, one of the leading pharmacy chains in the United States, announced its decision to close 1,200 stores over the next three years as part of a strategy to “stabilize” its operations.

Of the 1,200 stores, 500 will cease operations in 2025, according to Walgreens CEO Tim Wentworth.

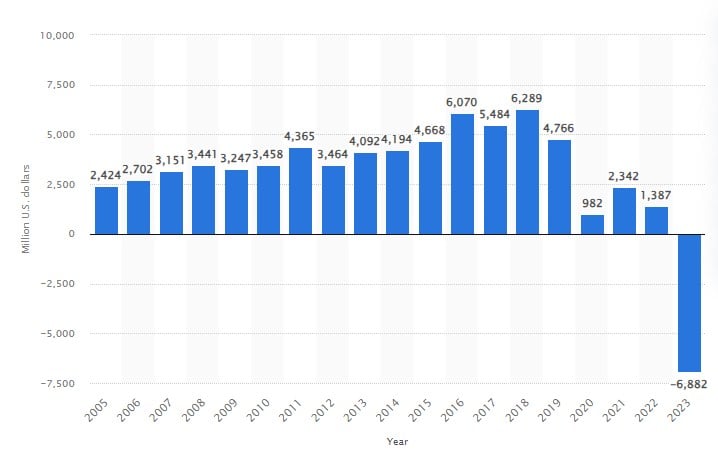

In a conference, Wentworth explained that the company is taking steps to improve the financial stability of its pharmacy network, focusing on reducing operating costs, optimizing cash flow, and adjusting reimbursement models to protect profit margins in drug sales.

Currently, around 6,000 of Walgreens’ more than 8,000 branches are profitable, leaving underperforming stores in a vulnerable position, which will be closed gradually.

“The 2025 fiscal year will be key for reorganizing our structure, as we focus on implementing our value-oriented strategy,” Wentworth said.

“Although these changes will take time, we are confident that in the long term they will translate into significant financial and customer benefits,” he added.

Operational Adjustments at Walgreens

Walgreens has not yet disclosed the exact locations of the stores that will close, but it is known that all affected stores are located in the United States.

The chain currently operates nearly 8,700 locations in the U.S., in addition to several thousand internationally.

During his address, Wentworth assured that the company would try to relocate employees affected by the closures to other areas within the organization in an effort to mitigate the labor impact.

This announcement adds to a series of cuts the pharmacy chain has been implementing over the past year.

In June, Walgreens communicated its intention to close a considerable number of underperforming stores in response to what it described as an extremely challenging operating environment.

At that time, Wentworth stated that the traditional retail pharmacy model was struggling to remain sustainable due to both decreased consumer spending and increased pressure on drug prices.

In addition, the company reduced its stake in VillageMD, ceasing to be the majority shareholder of this primary care clinic model.

Over the past year, Walgreens also eliminated hundreds of corporate positions as part of its restructuring plan.

Strategic Refocus and Private Brands

Wentworth aims to return to Walgreens’ roots as a retail pharmacy business, concentrating on areas where it has historically been stronger.

As part of this strategy, Walgreens is considering increasing the presence of private-label products on its shelves.

This approach includes products in the health and wellness categories, with a particular focus on women’s health.

In 2023, Walgreens launched more than 300 new products under its private label, and another 300 are expected to be introduced in 2025.

Despite these efforts, Walgreens’ comparable retail sales in the U.S. fell by 1.7% in the last quarter.

According to the company’s CFO, Manmohan Mahajan, this decline was mainly due to a drop in non-essential product categories.

Walgreens’ New Marketing Approach

Founded in 1901, Walgreens was for decades a key player in the U.S. pharmacy sector.

However, in recent years, the company has faced challenges both in terms of competition and adapting to changing consumer habits.

In the market, Walgreens remains a reference, but it struggles to differentiate itself from competitors like CVS and Rite Aid.