-

KKR, the world’s leading private equity firm, invests in FGS Global, bolstering the company’s growth and expansion in the strategic advisory and communications sector.

-

WPP retains majority ownership in FGS Global, with the partnership expected to drive innovation and enhance the company’s global presence.

WPP, the multinational communications and advertising conglomerate, has announced that KKR has made a growth investment in FGS Global, the strategic advisory and communications consultancy in which WPP is the majority shareholder.

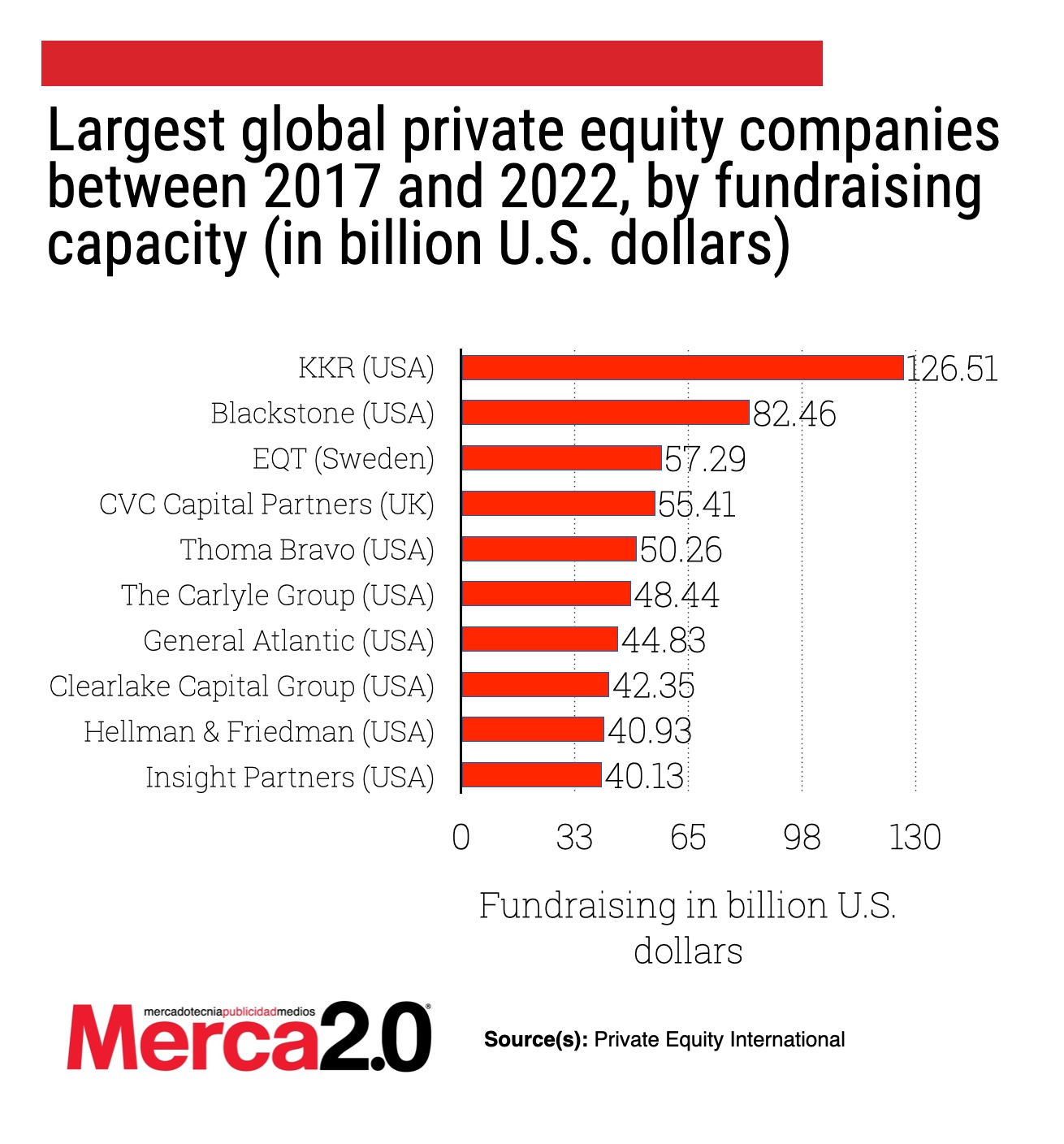

, a U.S.-based private equity (PE) firm, has gained prominence as the leading PE firm worldwide between 2017 and 2022, with a recorded fundraising sum of $126.5 billion, according to the Statista Research Department. KKR’s successful fundraising performance surpasses that of investment firm Blackstone, which comes in second place and is also based in the United States.

, a U.S.-based private equity (PE) firm, has gained prominence as the leading PE firm worldwide between 2017 and 2022, with a recorded fundraising sum of $126.5 billion, according to the Statista Research Department. KKR’s successful fundraising performance surpasses that of investment firm Blackstone, which comes in second place and is also based in the United States.

FGS Global, created through the combination of the industry-leading firms Finsbury, The Glover Park Group, Hering Schuppener, and Sard Verbinnen & Co, has become a dominant player in the financial communications sector. Boasting 1,300 experts worldwide, FGS Global guides clients in navigating complex situations and reputational challenges. In 2022, Mergermarket ranked the company as the number one global PR firm for deal count and value. FGS Global advised on 322 deals with a combined value of over $657 billion that year.

The company’s advisory services encompass strategic communications, corporate reputation, crisis management, and government affairs. FGS Global operates from global offices in 27 cities across the world.

Following KKR’s investment, WPP will maintain its majority ownership in FGS Global, while its employees will continue to hold substantial shares. In addition, private investment firm Golden Gate Capital will exit its investment by selling its interest to KKR. The transaction, which values FGS Global at $1.425 billion, is expected to close before the end of the third quarter of 2023, subject to regulatory approvals and customary closing conditions.

KKR, one of the world’s leading investment firms, invests in FGS Global primarily through its European Fund VI. The strategic partnership is expected to propel FGS Global’s continued growth, foster innovation in its service offering, and expand its international presence in the resilient and growing strategic advisory sector.

Mark Read, CEO of WPP, commented on the transaction: “FGS Global has established itself as a global leader in strategic advisory and communications, providing board-level counsel to the world’s leading companies and organizations. We are delighted to welcome KKR as a new strategic partner in FGS Global, in a transaction that recognizes the tremendous value of the business and its potential for continued strong growth.”

With this strategic partnership, FGS Global is well-positioned further to solidify its leadership in the financial communications landscape, offering innovative solutions and increasing its global footprint. In addition, the involvement of KKR, the leading private equity firm in the world, underscores the potential for growth and innovation in the strategic advisory sector.