-

Half of the most valuable brands in Latin America belong to sectors such as banking (18%), retail (15%), beers (9%), or oil and gas (8%).

-

The brand of the Brazilian bank Itaú leads the ranking with a brand value of USD 8.7 billion, surpassing Corona Extra.

-

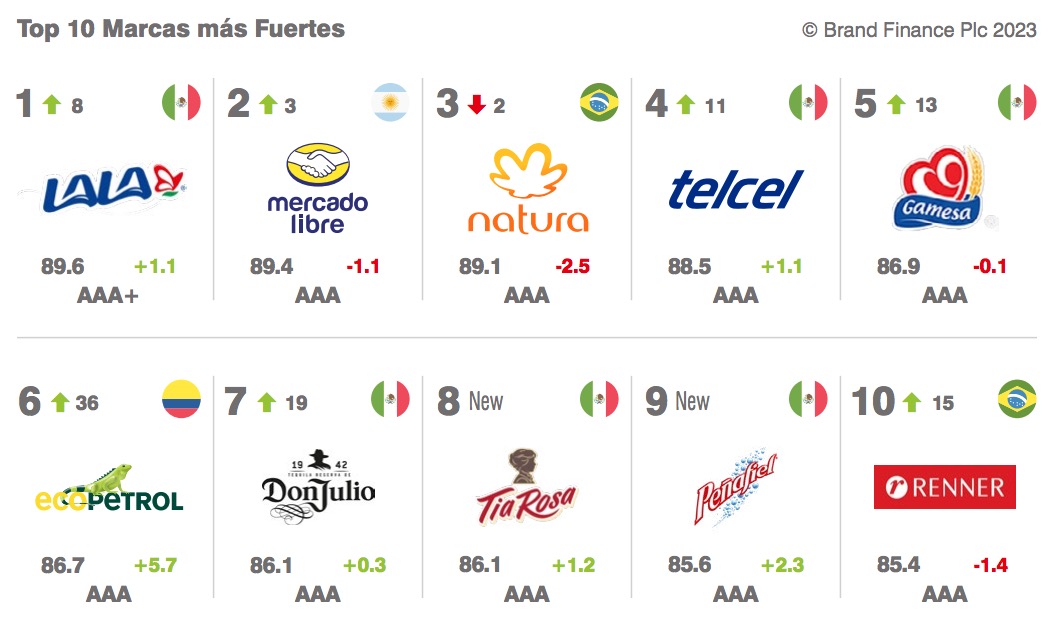

Lala stands out as the strongest brand in Latin America, achieving a score of 90 out of 100 on the Brand Strength Index and attaining the AAA+ rating, the highest possible.

In the dynamic landscape of brands from Latin America, a recent report by Brand Finance has shed light on the powerhouses dominating the region’s market. The study, which annually analyzes over 5,000 of the world’s most important brands, delves into the realms of finance, retail, beer, and energy to determine the top contenders.

Financial Giants at the Helm

Topping the charts with a brand value of USD 8.7 billion is Brazil’s Itaú, leading the financial sector’s charge. Its brand value surged by an impressive 32%, signaling a robust financial performance in 2022. The bank’s success is attributed to a higher financial margin with customers, increased fees, and gains in insurance, particularly in the card business. With a strategic focus on digital platforms, Itaú has witnessed a significant uptick in digital product purchases.

Pilar Alonso Ulloa, Managing Director for Iberia and South America, emphasized the growing importance of the banking sector, with trust, digital excellence, customer service, and accessibility driving growth.

Rising Stars in the Financial Arena

Notably, Athene, an insurance company based in Bermuda, witnessed the most substantial growth, soaring by 128% to reach a brand value of USD 2.6 billion. The merger with Apollo Global Management, Inc. and heightened sales of annuities fueled this remarkable ascent.

Mexico’s Fortitude in Latin American Brands

Mexico’s Lala stands tall as the most robust brand in Latin America, scoring an impressive 90 out of 100 on the Brand Strength Index (BSI). With a brand value increment of 4% to USD 666.6 million, Lala outshone Argentina’s Mercado Libre. Lala’s dominance is evident in its top scores for familiarity, consideration, and loyalty among Mexican consumers.

The company reported a robust performance in Q2 2023, registering a 5.6% increase in sales compared to the same period in 2022. This growth is attributed to the strength of its brands, operational flexibility, and recovery in inputs. Lala’s strategic reinvestment of MXN 1,171 million (USD 68.5 million) to expand capacity and maintain facilities showcases its commitment to sustained growth.

Sustainability as a Brand Pillar

Corona Extra, with a brand value hike of 6% to USD 7.4 billion, claims the second spot in the Brand Finance ranking. Notably, the brand excels in perceived sustainability, with a Sustainability Perception Value of USD 692 million. As a brand deeply connected with nature, Corona Extra has positioned itself as a leader in combating plastic pollution. The Mexican beer giant has achieved the remarkable feat of being the first global beverage brand with a net-zero plastic footprint worldwide.

In a nutshell, Latin America’s brand landscape is witnessing a shift where financial prowess, strategic mergers, and a commitment to sustainability are defining factors. As these brands continue to evolve, the competition for the top spots in Brand Finance’s annual rankings is sure to intensify, shaping the narrative of brand dominance in the region.

MUST Read Articles:

-

X Corp., Formerly Twitter, Faces Federal Lawsuit Filed by Marketing Agency

-

Unlocking the Secrets: Top 5 Marketing Tactics Credit Card Companies Use to Attract Young Adults

-

Restorerz Emergency Services Chooses Ripley PR to Boost Brand Awareness and Growth

-

Getty Images Launches AI-Powered Image Generator with Commercial Confidence