In Mexico, the consumption of alcoholic beverages is more than just a trend; it is a cultural institution rooted in centuries of tradition. From celebratory gatherings to quiet moments shared over a bottle of beer, alcohol plays a significant role in the daily lives of many Mexicans. In 2024, this market is not only thriving but also evolving, influenced by shifting consumer preferences, rising global interest in Mexican brands, and innovations within the industry itself.

A Toast to Growth — The Revenue Boom

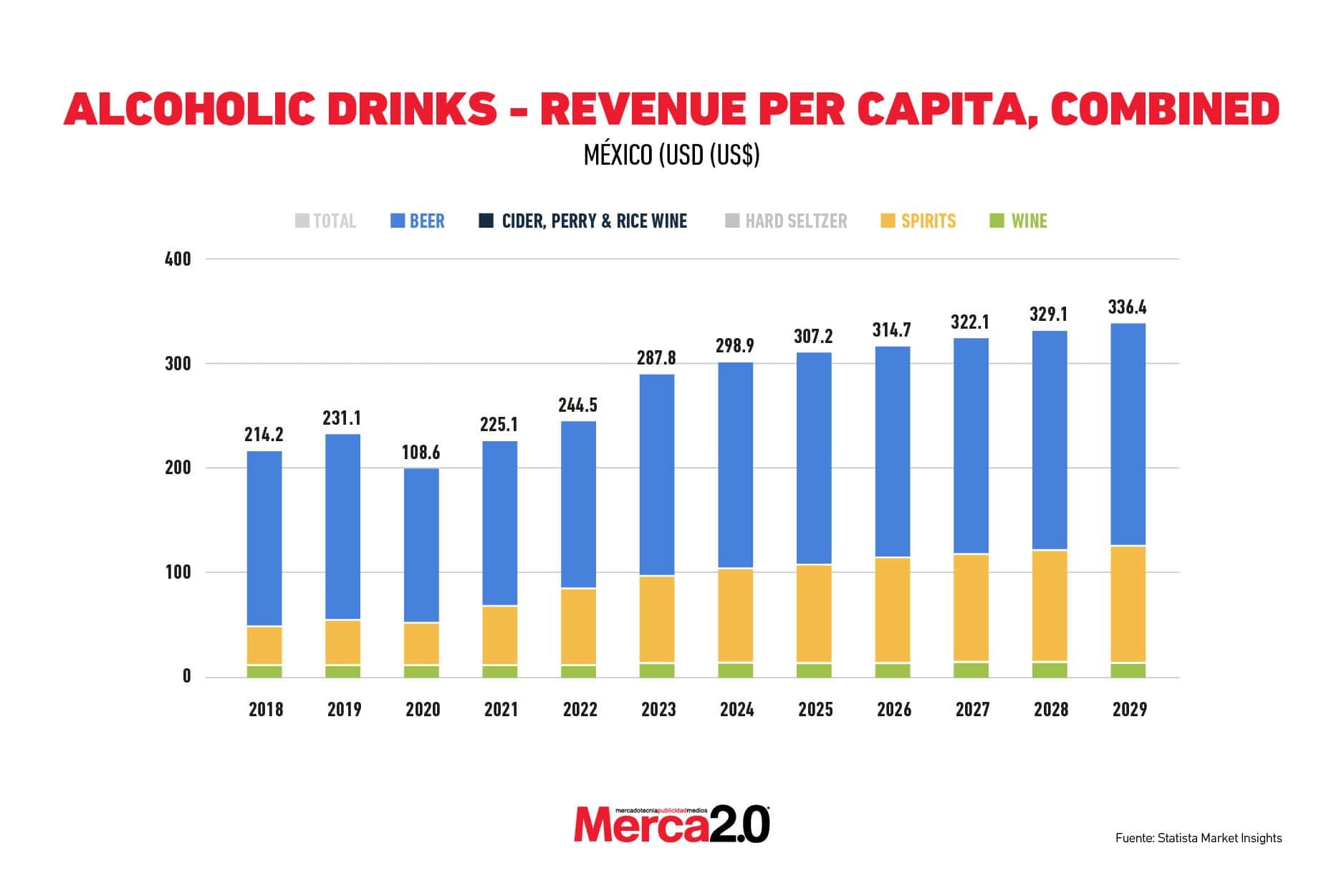

If there’s one story to tell about the Mexican alcoholic drinks market in recent years, it’s one of growth. In 2023 alone, the revenue generated by at-home consumption of alcoholic beverages was a staggering $18.45 billion USD, dominated by the beer industry. This isn’t just a blip; it’s part of a long-standing trend, with projections showing that by 2029, the total revenue is expected to reach $20.94 billion USD.

Beer, in particular, remains the undisputed king, making up the lion’s share of this figure. Brands like Corona and Modelo, which have become household names globally, are flying off shelves at home as well. But it’s not just about volume; there’s a shift happening in the market. More Mexicans are seeking premium experiences, willing to spend a little more for higher-quality brews and specialty beers, reflecting a global movement toward craft and artisanal options.

However, beer isn’t the only player in this field. The cider, perry, and rice wine market, while considerably smaller, is showing signs of life. In 2023, these beverages contributed $0.10 billion USD to the overall market, and although the growth here is incremental—projected to reach $0.12 billion USD by 2029—this shift points to a diversification in Mexican palates. Cider, with its refreshing and lighter appeal, is quietly finding a niche among health-conscious drinkers and those looking for alternatives to heavier beers and spirits.

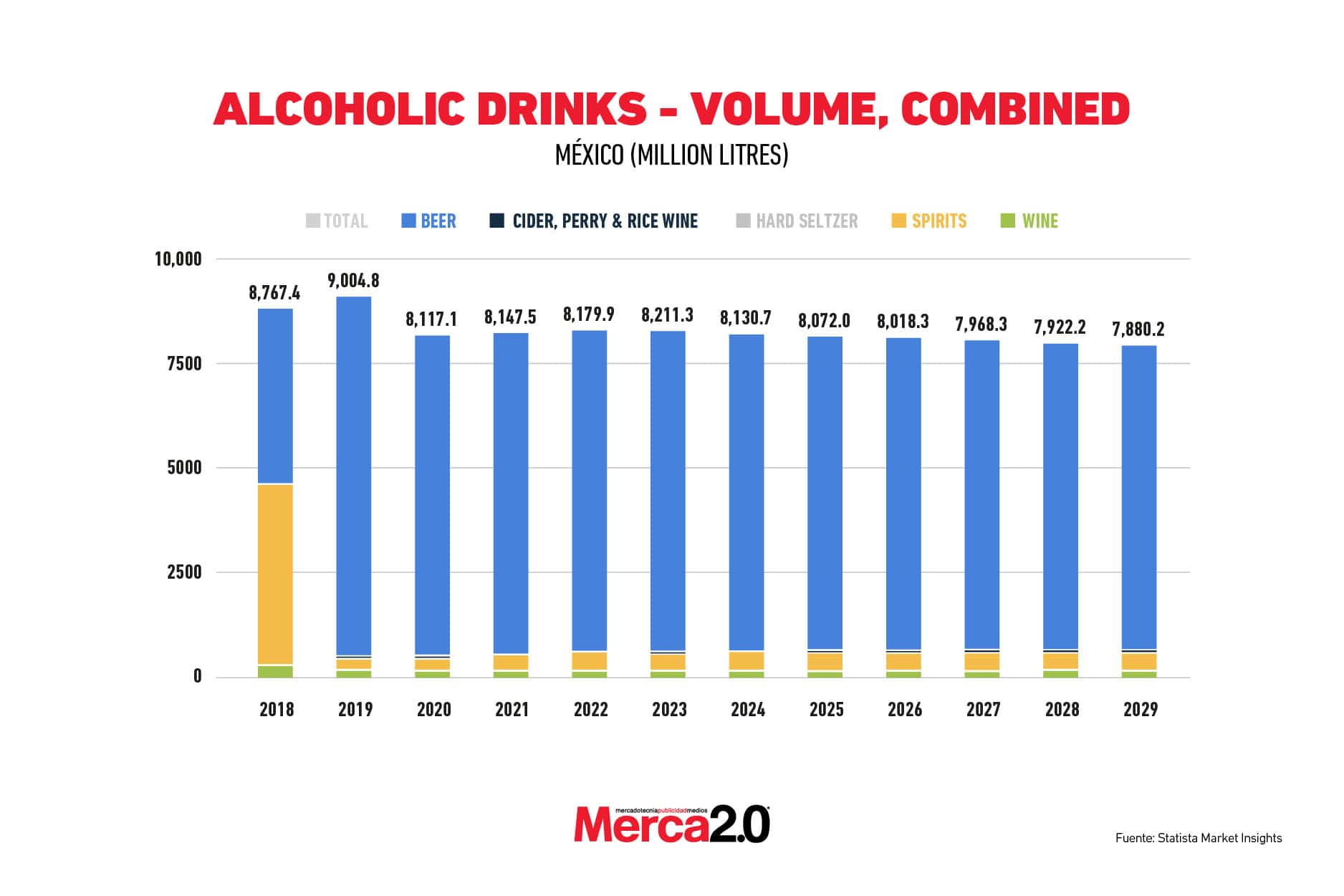

Volume Speaks Louder Than Words — Consumption Patterns

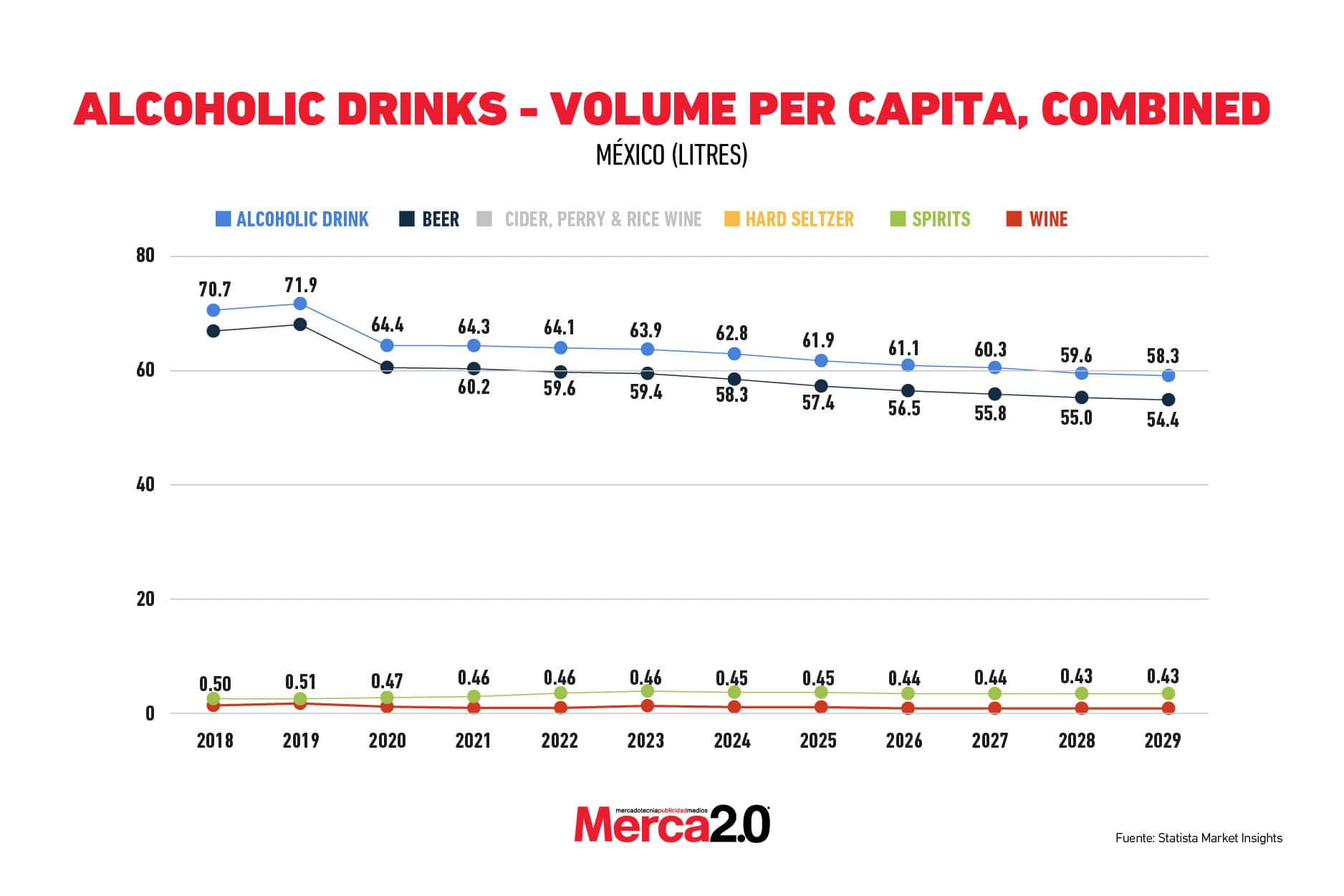

While revenue growth paints a strong picture of market performance, the consumption volume tells an even more compelling story. With its historic dominance, the beer market consumed millions of liters in 2023 alone. The sheer scale of beer consumption in Mexico is a testament to this beverage’s central role in social gatherings, holidays, and even casual family meals.

But there’s more at play. Traditionally led by tequila and mezcal, the spirits market is gaining ground. These iconic drinks are symbols of Mexican identity and are increasingly favored by a global audience, further boosting domestic consumption. The data indicates that as younger consumers appreciate high-quality, artisanal products, the volume of spirits consumed locally rises. This shift is noticeable in traditional and premium spirits, with tequila leading the charge as Mexico’s most famous export and mezcal growing in popularity among adventurous drinkers looking for bold, smoky flavors.

The cider market, though not heavy in terms of volume, is emerging as a contender. With a growing interest in lighter, less alcoholic alternatives, especially among younger generations and those seeking a healthier lifestyle, cider is carving out its space. The gradual increase in cider consumption mirrors global trends, where consumers are drawn to low-calorie and gluten-free options that offer a refreshing change from the more traditional offerings.

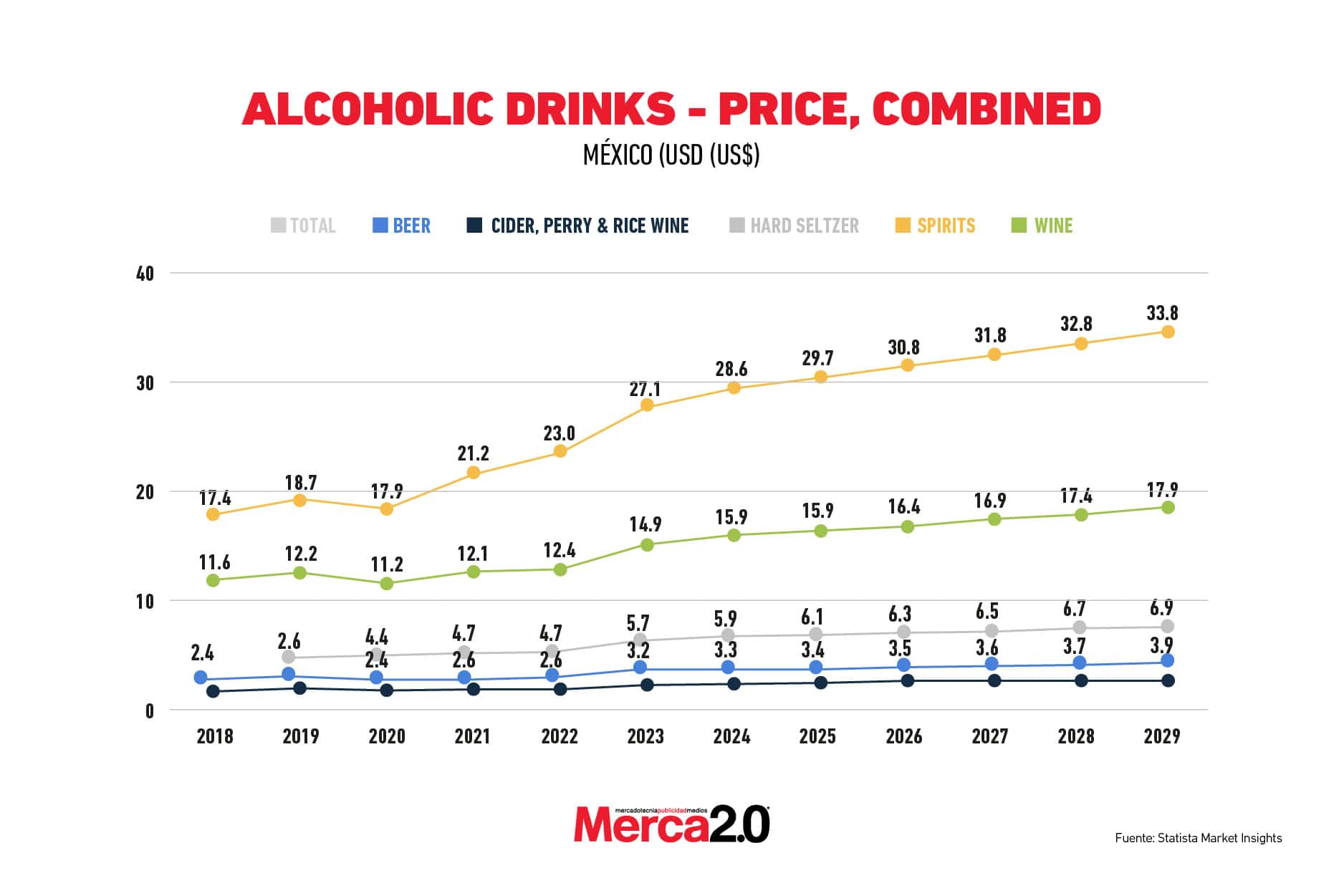

Prices in Flux — The Cost of a Good Drink

While Mexicans continue to enjoy their drinks, pricing in the alcoholic drinks market has become a more complex issue in recent years. Inflationary pressures and supply chain challenges have led to modest price increases, particularly in the beer and spirits markets. Nevertheless, beer remains affordable for most consumers, with mainstream brands maintaining their price point to stay competitive.

However, the most significant price hikes are in the premium and craft beer markets. Mexicans are increasingly willing to pay more for quality, and craft beers now occupy a space once reserved for more affordable options. This trend aligns with the global rise of the craft beer movement, where unique flavors, local sourcing, and small-batch production are highly valued.

Meanwhile, the spirits market has seen sharper price shifts, particularly for tequila and mezcal, driven by rising demand and challenges in sourcing raw materials like agave. Agave shortages in recent years have contributed to significant price jumps, especially for high-end, artisanal spirits. Even so, the thirst for premium tequila and mezcal remains strong, with consumers willing to pay for the authenticity and craftsmanship these products embody.

The Changing Marketplace — New Ways to Shop for Alcohol

The way Mexicans buy their alcohol is changing. Gone are the days when most purchases happened in brick-and-mortar liquor stores. Today, e-commerce is reshaping the alcoholic drinks market in Mexico. The COVID-19 pandemic accelerated the shift to online shopping, and many consumers have held onto the convenience of buying their beverages online. Alcohol delivery services and online liquor stores now offer a direct-to-consumer experience, with digital promotions, personalized offers, and subscription-based models becoming increasingly popular.

But traditional bars and restaurants are making a comeback. After the pandemic-induced closures, these venues are again central to alcohol sales, particularly for spirits and premium beers. On-premise consumption is rebounding, with consumers enjoying the social experience of drinking in public. The renewed interest in high-end cocktails and artisanal beverages in bars is helping to drive the premium market forward.

A Global Force — Mexico’s Place in the World of Alcohol

Globally, Mexico’s alcoholic drinks industry holds a unique position, particularly in the beer market. Mexican beer is not just a domestic success; it’s a global phenomenon. Brands like Corona and Modelo are among the most recognized and consumed beers worldwide, with exports accounting for a large portion of their success. Yet, within Mexico, these brands continue to dominate, and their local consumption remains robust, supported by the population’s deep cultural ties to beer.

Mexico’s alcoholic drinks industry is highly competitive compared to other markets, particularly in the beer and spirits segments. While Mexico’s per capita alcohol consumption is lower than that of countries like Germany or the UK, the market benefits from a mix of mass-produced and artisanal offerings. This blend appeals to a broad spectrum of consumers, from the price-conscious buyer to the premium-seeking connoisseur.

What’s Next — The Future of Alcohol in Mexico

The future of the Mexican alcoholic drinks market is one filled with opportunities and challenges. On the one hand, there is clear potential for further growth, particularly in the premiumization of beverages. Craft beers, artisanal spirits, and even organic ciders are areas ripe for expansion. Consumers are becoming more discerning, seeking quality over quantity, and favoring brands that align with their values, such as sustainability, local production, and health-consciousness.

On the other hand, the industry faces hurdles. Rising inflation, potential regulatory changes, and the ever-present challenge of supply chain disruptions could pose risks to both pricing and availability. Yet, the rewards are substantial for brands that can navigate these obstacles. Mexico’s rich tradition, combined with its growing middle class and youthful demographic, ensures that this market will continue to be a significant player on the global stage.

In conclusion, the story of Mexico’s alcoholic drinks market 2024 is one of growth, diversification, and resilience. As consumer tastes evolve and new market opportunities emerge, the industry remains a central part of Mexico’s economy and cultural fabric. The journey from a beer-loving nation to a haven for craft spirits and innovative alternatives is just beginning, and the next chapter promises to be just as exciting.